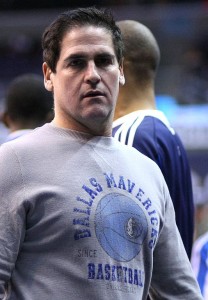

Mark Cuban the owner of the NBA Dallas Mavericks was participating in a June 2004 celebrity golf tournament when an email came through from a Mamma.com top executive.

Mark Cuban the owner of the NBA Dallas Mavericks was participating in a June 2004 celebrity golf tournament when an email came through from a Mamma.com top executive.

The email was from Guy Faure, the CEO of the company and asked Cuban to call him as soon as possible.

Cuban the self-made billionaire from Dallas was the Canadian Web firm’s largest shareholder at the time.

Following over five years of back and forth legal wrangling, Monday the case will go before the jury in a federal courtroom in Dallas.

Lawyers from the SEC say that Faure gave confidential insider data to Cuban about the planned offering of new stock to investors that had been targeted by the company. The SEC also said that Cuban then sold all of his stake of 6% in the business.

Cuban, by selling the stock avoided potential losses of what was estimated at $750,000. However, Cuban says he received information that was not confidential, made no commitment to keep that information confidential and no agreement to keep his stock based on the information.

The Dallas Mavericks owner said he did not have a fiduciary duty with Mamma.com since he was not serving in an executive capacity with the company.

He said it has cost him a great deal of money and time to fight the SEC because he will not allow the government to bully him. He said he invited all those not sure of his innocence to read the evidence to see the truth for themselves.

If the jury sides with the SEC, the most it would receive would be $2.5 million.