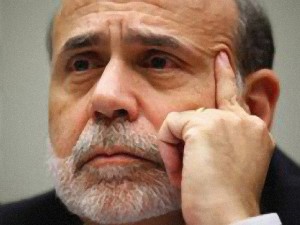

The U.S. economy was given a nod of approval by Federal Reserve Bank Chairman Ben Bernanke only a month prior to his departure from the bank. He announced the central bank would start the winding down of its bond buying stimulus program that has helped boost economic growth.

The U.S. economy was given a nod of approval by Federal Reserve Bank Chairman Ben Bernanke only a month prior to his departure from the bank. He announced the central bank would start the winding down of its bond buying stimulus program that has helped boost economic growth.

The Fed previously has pulled its stimulus program back, only to then restart them as the economy slowed. Now new challenges are looming, including a surprise slowdown in the rate of inflation. However, Bernanke said in his last press conference as chairman of the Fed that the U.S. economy was at the point it needed less Fed help.

Following months of worries of the implications of less stimulus if the Fed were to pull back on its bond purchasing program, investors gave Wednesday’s announcement a resounding approval. The investors cheered partly due to the promise to the Fed that interest rates for the short term would stay low following the end of the stimulus program.

An accord on the government budget approved on Wednesday in the Senate lays new groundwork for federal spending and tax policies for 2014 that restrict the growth of the economy less than in 2013.

The central bank, which started it latest bond buying program in September of 2012 in an attempt to spark the tepid recovery, is will now buy just $75 billion per month in Treasury and mortgage bonds starting in January. Included in that is $35 billion per month of mortgage securities while Treasuries will be $40 billion. It said it would like to cut the monthly purchases by that same amount at subsequent meetings going forward.

If the central bank continues on the pace set out, it would end its program of bond buying near the end of 2014, with total holdings of over $4.5 trillion.

However, officials still worried that investors might quake at the less support from the Fed and took great time in demonstrating that interest rates would be left low.