Forex brokers are an essential part of the life of a Forex trader. Essentially, no Forex trading can ever be possible without needing a Forex broker. However, since the industry has grown enormously, and hundreds and thousands of brokers have populated the market, therefore, it has become very difficult to find trusted lists of ECN Forex broker on the internet. However, following some tips and tricks you can find a reliable Forex broker to get along with. In this piece, we will be sharing some best tips to find the top ECN Forex broker on the internet.

Forex brokers are an essential part of the life of a Forex trader. Essentially, no Forex trading can ever be possible without needing a Forex broker. However, since the industry has grown enormously, and hundreds and thousands of brokers have populated the market, therefore, it has become very difficult to find trusted lists of ECN Forex broker on the internet. However, following some tips and tricks you can find a reliable Forex broker to get along with. In this piece, we will be sharing some best tips to find the top ECN Forex broker on the internet.

Before we move ahead, we would like to let you know what does ECN stands for? Also, what are different types of brokers available in the market? So, let’s start.

ECN Brokers VS Market Makers

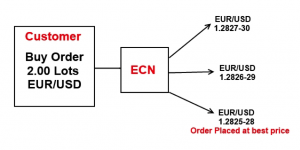

The Forex market is dominated by two types of brokers known as ECN/STP and MM. ECN stands for “electronic communication network”. Another name of ECN brokers is STP which means straight through processing. These brokers are also known as Non Dealing Desks. However, the other type of broker is called as MM – Market Makers or they are also called as Dealing Desks brokers. Now let’s figure out what is the difference between both types of brokers.

The Forex market is dominated by two types of brokers known as ECN/STP and MM. ECN stands for “electronic communication network”. Another name of ECN brokers is STP which means straight through processing. These brokers are also known as Non Dealing Desks. However, the other type of broker is called as MM – Market Makers or they are also called as Dealing Desks brokers. Now let’s figure out what is the difference between both types of brokers.

How To Find Top ECN Forex Brokers On the Internet

Having said that, we now move on enlisting few tips to find top ECN brokers on the internet

1. Google “Top ECN Forex Brokers”

As a very first step, you can try entering keywords in the search bar of Google. The search engine will display various links mentioning you the websites who maintains a list of top ECN Forex brokers such as topForexbrokers.com.

2. Check the Regulation Status of the ECN Forex Broker

Regulation of a broker has special importance when it comes to safe and sound Forex trading. Since Forex trading involves money, therefore, if a broker is regulated then you know your investment is in safe custody. Setting aside the security of investment, there are many other issues that a regulated broker is considered to be good for.

3. See If the ECN Broker Offers A Demo Account?

Most of the brokers offer demo account services to its clients so they can learn and practice their trading skills without risking their real investment. A regulated broker would not bare you to use a demo account for any good reason. However, if you see, a broker is not offering a demo account, then you may reconsider your decision for opening an account with it. Think for a while, why a broker wouldn’t allow you to test their system? Are they trying to conceal something? Or the broker doesn’t want you to know the lope hole.

4. Balance Requirement

Often brokers allow you to get started with low balance. This can be appealing at times. But it may also mean that the broker doesn’t care if you win or lose. All it wants is to not let you go by allowing you to deposit as much as you can. Although this is not the case with all brokers. Many good Forex brokers may also allow you to start low. However, a regulated Forex broker would normally require you to get started by depositing $250 – $500 at least.

5. Scrutinize the Broker by Opening a Micro or Mini Account with an ECN Broker

You can also consider opening an account with an ECN Forex broker in order to have an idea about the overall operations of the broker. Opening a micro account or mini account would not require you to deposit a lot of money, you can get started by depositing a few dollars only. By opening a micro or mini account you are allowed to trade the market in real market conditions. You can easily figure out how fast the trade execution rate is, how quick the broker processes your withdrawal, what is the level of customer support available etc.

What’s next?

The list doesn’t end here. However, following above mentioned tips you can comfortably arrive at a point where you can make the decision as to whether you should go for a specific ECN broker or not.