Shareholder activism is the bailiwick of several exclusive hedge funds and other institutions that are invested in specific positions that includes Bill Ackman, Carl Icahn, Nelson Peltz, and David Einhorn. There is a resurgence of shareholder activism today.

Shareholder activism is the bailiwick of several exclusive hedge funds and other institutions that are invested in specific positions that includes Bill Ackman, Carl Icahn, Nelson Peltz, and David Einhorn. There is a resurgence of shareholder activism today.

Some see shareholder activism as selfish opportunism, especially when the motivation is to get some profit before they sell out their shares. The nation’s most popular corporate lawyer Marty Lipton and chief judge of Delaware Chancery Court said hedge funds who get in and out of companies are damaging the operations and finances without looking at the long term effect of their actions.

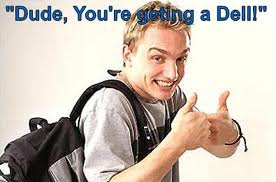

Take for instance the rivalry between Dell and Hewlett Packard as well as the industry’s big disruptor Apple, which has a cash balance that’s around a third of its $400 billion market capitalization. Dell planned to be a private company and offered a $13.65 per share by Chief Executive Officer Michael Dell and Silver Lake Management.

Dell has been under $9 per share as recently as last November. It has been a popular strategy made by hedge funds to take a position and announce it to the public. Their goal is to persuade others to do the same and drive the stock in their desired direction.

Dell’s Special Committee said they welcome Carl Icahn and other interested parties to participate in the go-shop process that will determine if there are third parties interested in offering alternative transactions that are better than the going-private proposal.